It’s great being able to spread the cost when you buy, but you always need to do your research on finance.

We’ve gathered the most frequently asked questions, from how it works to how much it costs, to give you peace of mind about PayPal Credit.

What is PayPal Credit?

PayPal Credit is like a credit card, without the plastic. It’s a credit limit that’s attached to your PayPal account which you can use for your online purchases.

If your application is successful, PayPal Credit will be available as a funding source within your PayPal wallet and can be used for purchases in most places where PayPal is accepted. You can make purchases in the same way as you would with a normal credit card, by choosing PayPal Credit as your funding source at checkout.

PayPal Credit will provide you with a monthly statement showing your transactions and detailing the minimum repayment amount. Repayments can be made by monthly direct debit, directly from your PayPal account or by speaking to our customer service agents. For further information on how you can pay your PayPal Credit balance, see the ‘Make a Payment’ section below.

For purchases less than £99.00, interest is charged at your standard variable rate if the full amount is not paid off by the date shown on your statement.

In addition, PayPal Credit lets you access two types of promotional offers:

- 0.00% for 4 months on all purchases of £99.00 and over; and

- instalment offers.

If you use any of these promotional offers, they will also be detailed on your monthly statement, as well as in the PayPal Credit section of your PayPal account.

How do instalment offers with PayPal Credit work?

When you check out with PayPal Credit, you’ll be shown a selection of instalment offers which enable you to spread the cost of your purchase across a number of repayments. These instalment offers vary by merchant and allow you to choose a set monthly repayment over a period from 12 to 48 months to help spread the cost of larger purchases in a more manageable way.

Instalment offers will always have an interest rate lower than the standard variable rate, and many merchants offer 0.00% instalments with PayPal Credit. If you already have PayPal Credit, you can take advantage of these offers without having to reapply as long as you have enough available credit limit.

It is important that you think about whether you can afford the monthly repayment agreed for any instalment offer. This will be added to your monthly minimum repayment amount and will need to be paid each month.

If you fail to make repayments or in certain other circumstances, PayPal may remove your offer and any outstanding amount will be charged at your standard variable rate. Please see the Credit Agreement for more details.

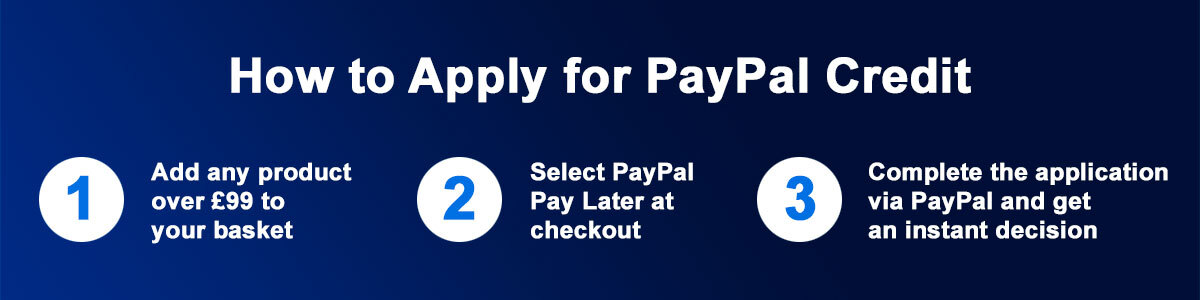

How long does it take to apply for/receive PayPal Credit?

The application form takes minutes to complete. PayPal will run a credit check and if approved, you’ll have a credit limit linked to your PayPal account as soon as you accept your credit agreement. This approval process will only take a few seconds and then you’re ready to go.

How much will my credit line be?

To determine the size of your credit line PayPal use the information you provide in the application form along with internal PayPal data and an external credit check.

What if I don’t have a PayPal account?

The first stage of the PayPal Credit application process will ask you to sign into your PayPal account or offer you the opportunity to sign up for one. Once you’ve signed up for a PayPal account, you can begin the application for PayPal Credit. Signing up for a PayPal account is free and easy; all you need to do is provide your email address, create a password and accept their User Agreement.

Tell me more about the application process…

Can I apply for PayPal Credit?

Applying for PayPal Credit is easy. Simply complete the short application form on PayPal and, if approved and once you accept the Credit Agreement, you’ll have a credit limit linked to your PayPal account almost straight away.

Before you apply, please make sure you:

- Are a UK resident aged 18 years or older

- Have a good credit history

- Have not recently been declared bankrupt

- Are employed and have an income greater than £7,500 per year

Can I still apply if I have bad credit?

Of course, but just be aware that not everyone will be accepted for it. It’s worth remembering that PayPal will have to run a credit check as part of your application. So, your credit score will be taken into account when PayPal decide if you’ll be approved for credit.

When will I find out if I’ve been accepted for PayPal Credit?

It should only take a few minutes to apply, and you should find out straight away. This approval process will only take a few seconds and then you’re ready to go. There can be a time lag between approval and when you can view your PayPal Credit account online but this should update within a few days.

Will you do a credit check?

Yes, PayPal will always carry out an external credit search along with using internal PayPal data to determine the size of your credit line.

Will my credit rating be affected?

The full credit check might, and it’ll be recorded against your credit file.

What will you do with the information I give you?

There are details of how PayPal use your information to make a responsible lending decision in their privacy policy.

If my application’s declined, can I apply for PayPal Credit again?

You can reapply, but we’d suggest not doing it immediately. The best thing to do is to check your credit score and credit report online, then we’d advise waiting at least 35 days before you apply again.

If my application’s declined, can I appeal the decision?

PayPal will email you with more information about why your application for PayPal Credit was unsuccessful. If you apply during check out and get declined for PayPal Credit, you can still use PayPal to check out securely with your debit or credit card.

If you want to re-apply, you will be able to 35 days after your last application.

If I change my mind, can I cancel my PayPal Credit application?

You may withdraw from your PayPal Credit account by calling PayPal within 14 days of entering into the Credit Agreement. You may close your PayPal Credit account at any time, but must repay any outstanding balance.

I’ve been accepted for PayPal Credit, now how do I use it?

How do I manage my account?

You can keep track of your PayPal Credit activity and history by logging in to your PayPal account and selecting PayPal Credit.

Are there any fees I should be aware of?

Late Payments

If you’re late with a payment, PayPal may charge you a late payment fee of £12.00.

Returned Payments

You may be charged a return payment fee of £12.00 if you have insufficient funds to cover the payment.

Statements (Paper Copy)

PayPal also charge a fee of £5.00 if you request that they send you a printed copy of a previous statement. All statements are available to download or view online within the PayPal Credit section of your PayPal account.

For more information on how these fees apply, please refer to the Outline of Credit, the Standard European Consumer Credit Information document or the Credit Agreement.

How can I update my contact details?

1. Login to your PayPal account

2. Select the “Settings” icon

3. Update your contact details

I just opened up a PayPal Credit account, when is my payment due?

PayPal will automatically send you monthly reminders to notify you of when your payment is due. They’ll ask you to make your first payment around 35 days from when your PayPal Credit account was opened.

Other FAQ's

Can I choose which purchases to pay off first?

No. You cannot select which purchases to pay off first, as our system is designed to automatically apply your repayments to purchases with the highest interest rate first whilst also ensuring that any instalment offer plans are repaid within the term of the plan.

This means if you have any promotional offer purchases (0% p.a. interest for 4 months on purchases over £99) and are also repaying an instalment plan(s), our system will always allocate repayments over the minimum monthly payment to the instalment plan(s) with a higher rate of interest first. The exception is where your 0% p.a. for 4 months offer is going to expire in that month, in which case they will apply your repayment over the minimum monthly payment to that 0% for 4 months offer before the instalment plan.

However, this is to your advantage as it means you pay less interest overall across all of your PayPal purchases.

How are my minimum repayments calculated?

Your monthly minimum repayment will be shown in each statement and in the PayPal Credit section of your PayPal account. Any offers you have are also detailed in these locations.

Your minimum repayment amount is calculated based on your purchases, and will include:

- any instalment offer payments due for that month;

- the full balance if less than £5.00, or the higher of £5.00 or 2.00% of the outstanding balance (which excludes any instalment offer balances, but includes any 0.00% for 4-month offer balances); and

- any interest, charges, and arrears.

If you fail to make minimum repayments on time or in certain other circumstances, PayPal may remove your offer. Please see your Credit Agreement for more details.

What is persistent debt?

Persistent debt is defined as any customer who pays more in interest, fees and charges than they repay of the amount they borrowed (known as “principal”) in a rolling 18-month period (with a balance greater than £200.00 GBP during that time). PayPal will notify you if you consistently fall into this category at 18, 27, and 36 months.

How can I increase my payments?

PayPal Credit offers a few different ways for you to make payments.

You might consider setting up a Direct Debit, which is an easy way to pay the amount you choose automatically rather than having to make them manually yourself each month. To set up a Direct Debit or change your existing Direct Debit, log in to your PayPal account.

Alternatively, you can make or schedule an additional payment in your PayPal account by following the link above and clicking the “Make a Payment” button. You can also make a payment by calling PayPal on 0800 368 7155.

What do I do if I can’t afford to increase my minimum payment?

If you don’t think you’ll be able to increase your payments because of other financial commitments, you can call PayPal on 0800 368 7155. They’d like to help talk you through the options that may be available to you. They’re open 8.00am to 6.30pm Monday to Sunday.

What is a Representative APR and what is the Representative APR for PayPal?

A Representative APR (Annual Percentage Rate) is an advertised rate shown on products where you borrow money so that an easier and fairer comparison can be made. It’s the typical total cost of a credit product expressed as a percentage, spread over 12 months. The Representative Annual Percentage Rate for a PayPal Credit account is 23.9% (variable). If you receive this rate, this is also the standard rate of interest that will apply to your purchases.

The Representative APR is the rate that at least 51% of those accepted for PayPal Credit will get. That means almost half of those customers who are approved may not receive the advertised Representative APR and will receive a different rate.

If you are approved for PayPal Credit, the rate they give you will depend on your individual circumstances. [Your actual APR and standard rate of interest is set out in your pre-contract information and Credit Agreement.]

Sometimes your purchase will benefit from a promotional offer with a lower rate of interest. Your standard rate of interest will not apply to transactions charged at a lower interest rate during the promotional offer period. See your Credit Agreement for more details

PayPal may increase your standard interest rate by giving you at least 30 days’ notice. For more information on when they would do this please see your Credit Agreement.

What does subject to approval mean?

PayPal are required to carry out creditworthiness and affordability checks to determine if PayPal Credit is right for you. As part of this process, they review information held on you by credit reference agencies and other relevant information prior to approving you for PayPal Credit.

Is there a cooling off period if I want to close my PayPal Credit account?

You may withdraw from your PayPal Credit account by calling PayPal within 14 days of entering into the Credit Agreement. You may close your PayPal Credit account at any time, but must repay any outstanding balance.

Can I contact PayPal if I have any further questions?

For more information, you can call PayPal Customer Service on 0800 368 7155.

Hours of service:

Monday to Sunday 8am to 6.30pm (GMT)

If you’re calling from outside the UK, call 0044 800 368 7155.

Appliance House Ltd is a credit broker, not a lender and is authorised and regulated by the Financial Conduct Authority (FRN 733878), offering finance from a restricted range of finance providers.

PayPal Credit and PayPal Pay in 3 are trading names of PayPal UK Ltd, Whittaker House, Whittaker Avenue, Richmond-Upon-Thames, Surrey, United Kingdom, TW9 1EH. Terms and conditions apply.

Credit subject to status, UK residents only.

PayPal Pay in 3 is not regulated by the Financial Conduct Authority. Pay in 3 eligibility is subject to status and approval. 18+. UK residents only. Pay in 3 is a form of credit. Check if affordable and how you will repay. May make other borrowing more difficult or expensive. See product terms for more details.